This year’s update to the Renewable Energy Standard will require a dramatic increase in the deployment of distributed generation in Vermont. Outside of the state’s net-metering program, Vermont does not have any renewable generation procurement programs or incentives as the authorized capacity in the Standard Offer program has been filled. The Standard Offer program was established in 2009 to promote the deployment of distributed renewable generation up to 2.2 MW in size. The program was initially authorized to procure 50 MW of generation which was later increased to 127.5 MW. Since 2013, the Public Utility Commission and Standard Offer Facilitator have issued an RFP for 5-10MW of capacity annually, with the lowest-priced qualified bids awarded Standard Offer contracts. The final RFP for the Standard Offer program was issued in 2022. REV analyzed data from the Standard Offer Facilitator and the Public Utility Commission to better understand how the program has operated over the last decade and inform the development of future procurement programs.

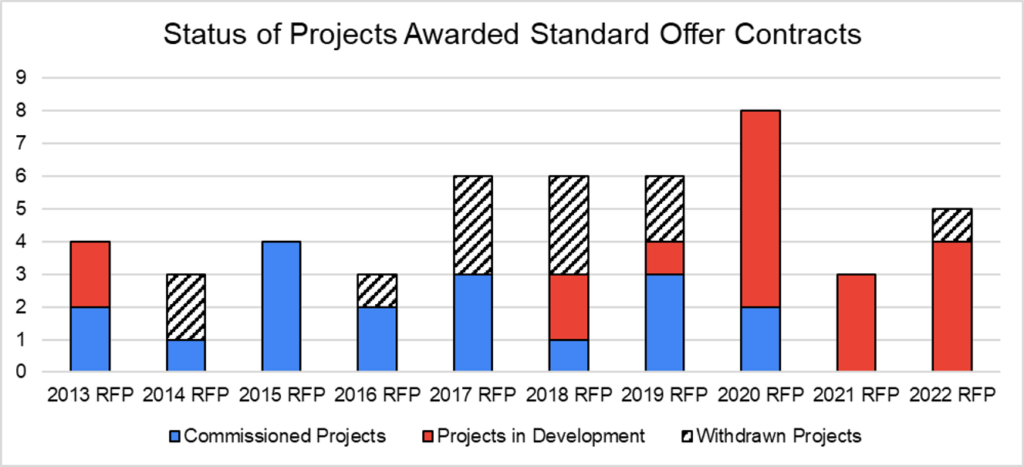

In total 78 solar projects have been awarded Standard Offer contracts of which 47 are now in operation, 13 projects have withdrawn from the program, and 18 are still in permitting or construction.[1]

The status of solar awards since 2013 is shown below. Of the original 50 MW tranche, 29 of 30 projects awarded contracts have been commissioned and 1 project withdrew.

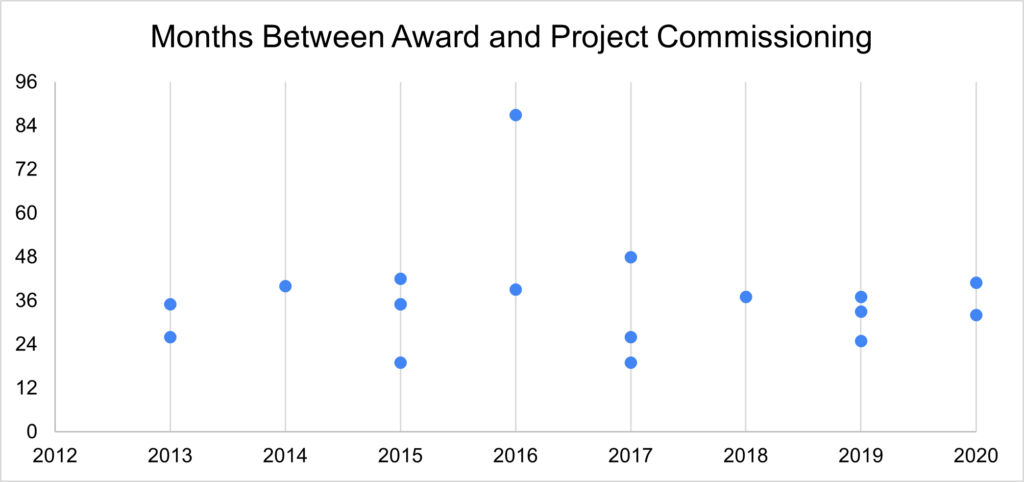

For those projects that have been commissioned, a majority of projects were commissioned within 3 years of being awarded a Standard Offer contract, and all but one within 4 years. Note that this does not include projects that are still in development, including 2 projects each from 2013 and 2018.

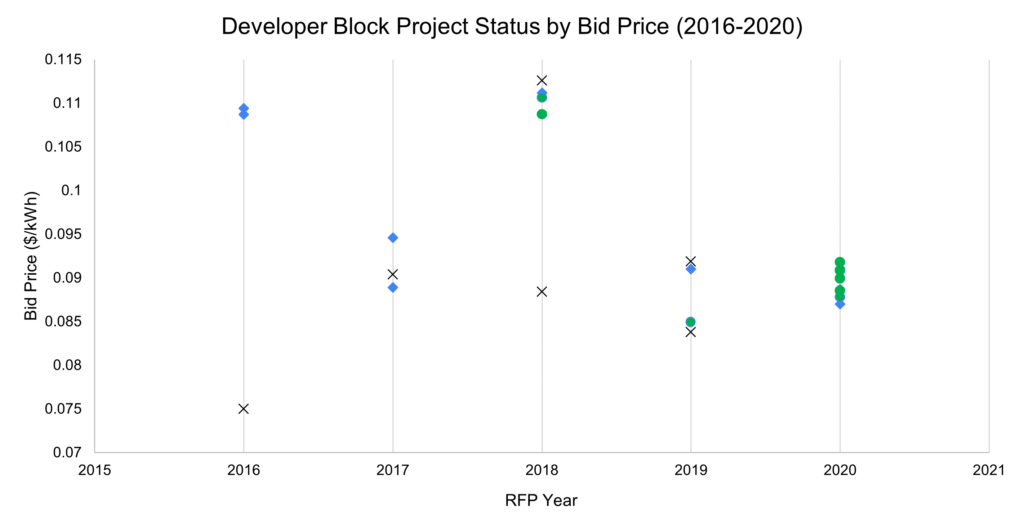

Ten of the 13 solar projects that withdrew from the program were awarded between 2016 and 219. Four of these withdrew a year of being award (171 days on average), five withdrew between 1 and 2 years after the award (502 days on average, and only a single project withdrew after more than 2 years (781 days). Provider and Developer projects withdrew at equal rates, 2 out of 5 (40%) Provider Projects and 6 out of 15 (40%) Developer Block Projects. Two of the withdrawn projects were clear outliers on price (2-3 cents/kWh below the next bid in the same year) but the other withdrawn project submitted similar bids to projects that have been commissioned or are still in development.

Since 2020, 11 of 14 projects award contracts have received a CPG,1 project has withdrawn,1 CPG is pending and 1 appears not to have filed for a CPG. The 11 projects that have received a CPG averaged 16 months for CPGs to be awarded after the announcement of the Standard Offer winners. Historically, the vast majority of solar projects that have withdrawn from the Standard Offer program have done so within two years. We are more than two years out from the last Standard Offer award notice. If historical precedent holds, most of these 2020 and later projects will be commissioned.

[1] The Standard Offer program includes carve-outs for other technologies but solar composes the vast majority of the capacity awarded and our analysis is limited to solar Standard Offer projects.